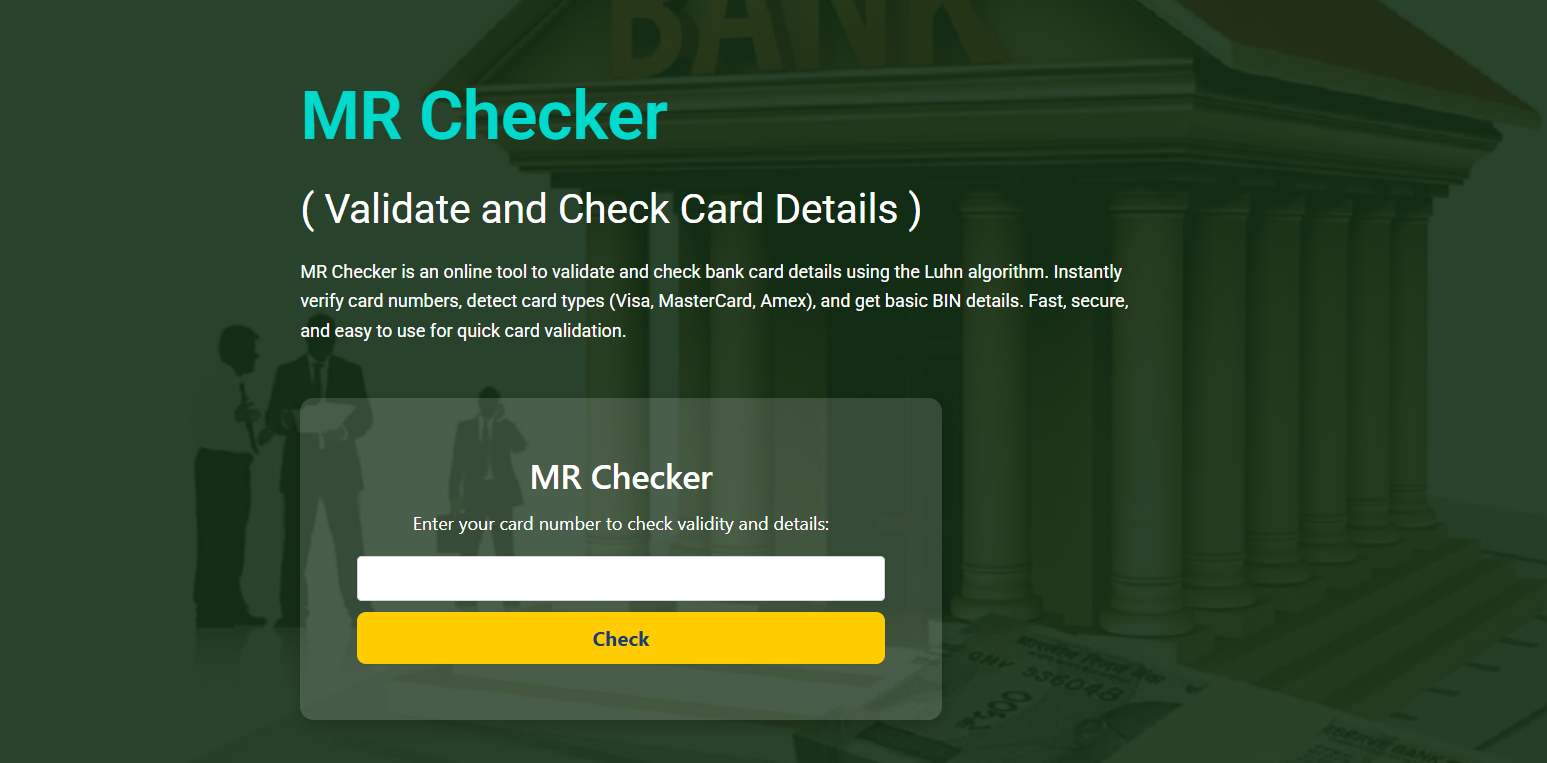

When using a credit card checker online, speed and accuracy are essential. MR Checker is built to recognize and display card type details within moments of entering a card number. Whether it’s Visa, MasterCard, American Express, or others, the system provides instant insights. This feature saves users time, ensures clarity, and supports fraud prevention across various applications.

Card type detection is more than just cosmetic labeling. It plays a role in transaction routing, security layers, and system compatibility. MR Checker gives users a trusted way to instantly know what kind of card they’re dealing with. This makes it valuable for developers, businesses, and anyone managing online payment systems or BIN data.

Let’s take a deeper look into how MR Checker detects card types so quickly, how reliable the process is, and why this matters for both everyday users and professionals handling card-based platforms.

How Instant Card Type Detection Works

The Role of BIN Prefix in Card Identification

Every credit card number starts with specific digits that identify the card type and issuer. These initial numbers are called the Bank Identification Number or BIN. MR Checker uses this BIN to determine the card category. It compares the input against a constantly updated database to identify whether the card is Visa, MasterCard, Amex, or another type.

The BIN check happens in real time, which means the card type appears immediately after entering the number. This is extremely useful for anyone needing fast validation. Since each card type has a distinct prefix range, MR Checker can make precise classifications without delay.

Matching Patterns Across Card Networks

Different card networks follow predictable number structures. MR Checker uses these known patterns to identify which network a card belongs to. For example, Visa cards often start with the digit 4, while MasterCard usually begins with 5. These rules help the system detect the brand with a high level of confidence.

As new cards enter circulation, MR Checker updates its detection rules. This ensures compatibility with changing card formats and global banks. The tool does not rely on guesswork. Instead, it uses a mix of pattern recognition and BIN data to classify cards instantly.

Fast Response for Streamlined Verification

One major benefit of MR Checker’s card detection is speed. The entire process, from input to output, takes less than a second. Users don’t need to refresh the page or wait for results to load. Once the number is entered, the interface instantly displays the card type and related BIN data.

This speed is essential for businesses that need to process multiple cards quickly. It also enhances the user experience, reducing delays during form submissions or test scenarios. Whether you’re verifying one card or dozens, MR Checker maintains rapid, reliable performance.

Why Card Type Detection Matters

Enhancing User Verification Systems

Knowing the card type during entry improves the quality of user input. Online forms can dynamically adjust fields based on card brand. For example, American Express cards have a different CVV format and length than Visa. MR Checker gives sites the ability to prepare for these differences ahead of time.

This leads to fewer input errors and better compatibility. Developers can design smarter payment pages by tapping into MR Checker’s detection system. For users, this translates to a more intuitive checkout or signup experience.

Boosting Fraud Prevention and Risk Analysis

Card type recognition also plays a role in fraud detection. If a card type doesn’t match expected usage patterns, the system can flag it for manual review. MR Checker allows for pre-checks that act as an added security layer. Merchants can use the tool to screen entries before initiating a transaction.

By comparing the detected card type against user claims, businesses can reduce risk. It’s an effective method for strengthening trust in online transactions. While not a complete fraud solution, MR Checker contributes to a more secure environment.

- Recognizes Visa, MasterCard, Amex, Discover

- Uses real-time BIN matching

- Supports form optimization and risk controls

Accuracy of MR Checker Results

Regular Updates to BIN Databases

Card types and formats evolve over time. New banks issue cards, old prefixes retire, and global standards shift. MR Checker adapts by consistently updating its BIN database. This ensures the system remains relevant and correct as card ecosystems change.

The updates happen quietly in the background. Users don’t have to worry about outdated information. MR Checker manages its detection standards internally to reflect the latest industry trends. This is what keeps the results dependable.

Minimal False Detections Observed

False results can cause confusion during validation processes. MR Checker minimizes this risk through strict validation logic. Because the platform relies on both prefix structure and BIN match, its accuracy stays high. Incorrect matches are rare due to cross-referenced checks.

Even with non-standard cards or lesser-known issuers, MR Checker typically delivers reliable data. If a number doesn’t align with any known format, the tool avoids misclassification and may alert the user that the card is unrecognized.

Trusted Across Multiple User Types

MR Checker isn’t only for technical users. Freelancers, merchants, customer service reps, and curious individuals all benefit from its detection ability. It delivers professional-level precision without needing special training. This wide usability makes it a go-to tool for anyone dealing with card data.

The platform’s design keeps everything transparent. Results are readable, outputs are direct, and feedback is clear. All of these elements reinforce trust in its card recognition capabilities.

Supporting Tools Behind Card Type Detection

Use of Luhn Algorithm in Tandem

While the Luhn algorithm is primarily used for validating card numbers, it also plays a supporting role in type detection. By first confirming that the number is structurally valid, MR Checker ensures that detection doesn’t occur on invalid input. This enhances the overall reliability of the process.

When combined with BIN matching, the Luhn test filters out random or malformed entries. The two systems work side by side to boost confidence in the displayed results. It’s an intelligent way to confirm legitimacy.

Integration with BIN Databases

MR Checker links to an extensive BIN database, which serves as the foundation for card type detection. This database includes card brand, issuer bank, and even the card’s country of origin. Each number entered is scanned and compared against these records.

This backend support ensures not only speed but also precision. If a BIN is missing from the database, MR Checker identifies it as unknown, avoiding bad data. Constant refinement keeps the tool current with financial institutions worldwide.

Advanced Filtering for Format Compliance

Apart from checking prefixes and applying Luhn logic, MR Checker also filters entries for format compliance. For example, American Express cards typically have 15 digits, while Visa has 16. These rules are built into the tool. Any entry outside the norm is flagged instantly.

This filtering prevents false positives and ensures users only proceed with valid input. The system acts like a gatekeeper, making sure all data aligns with known card standards before classification.

- BIN data sourced from trusted financial repositories

- Luhn and format checks included

- Constant backend maintenance for accuracy

Limitations to Consider

Not a Payment Processor

While MR Checker can detect and validate card numbers, it doesn’t process transactions. Users should understand that the tool is for informational purposes only. No money is moved, and no card data is saved or stored during checks.

It’s best used as a pre-screening tool, not a replacement for secure payment systems. This limitation ensures that MR Checker stays lightweight, safe, and easy to use without needing extensive permissions or integrations.

Avoiding Real Card Usage

Users should never enter their personal or active credit card numbers into public tools. Even though MR Checker is designed to be safe and secure, best practice is to use test or dummy card data. This is especially true in public or shared devices.

The platform reminds users not to submit sensitive financial information. Developers can rely on generated test cards to assess the tool’s capabilities without exposing private data.

The best way to use MR Checker is for learning, development, or system validation purposes. It’s effective, but must be used responsibly.

Conclusion

MR Checker detects card types instantly using a combination of BIN database matching, pattern recognition, and real-time validation tools. It’s fast, accurate, and serves a range of users from developers to merchants. For safe, smart, and efficient card classification, MR Checker is a top choice online.